Many ecommerce merchants use Amazon as a sales channel for a variety of completely justifiable reasons. If it isn’t the fact that they’ve got a massive audience of product hungry customers, it might be because of Fulfillment By Amazon (FBA), their own fulfillment service.

But those last two words, fulfillment service, have been raising eyebrows lately. It’s got nothing to do with FBA (rest easy, you FBA adoring merchants) – instead, it has to do with the shipping as a whole, how it’s impacting Amazon’s performance, and what the massive marketplace is up to.

A Rumble in the Jungle

You would expect a company like Amazon to make a killing over Q4. It’s the holidays, consumers are programmed to spend their money, and Amazon offers a host of consumer benefits, from an expansive product catalog to low prices and prime shipping opportunities. As it turns out, they definitely did make a killing, performing well (on the surface) with the largest quarterly profit in its 20-year history and a revenue growth of 22%.

It seems like investors would praise such a performance, right? Quite the opposite – they’re pummeling Amazon with a plummeting stock price because the company failed to meet analyst expectations. Regardless of growth in sales, the mammoth marketplace’s profit, albeit existent, was weaker than many had hoped 2015’s exceptionally-ecommerce-oriented holiday season would rake in.

What Goes In Must… Go Back In

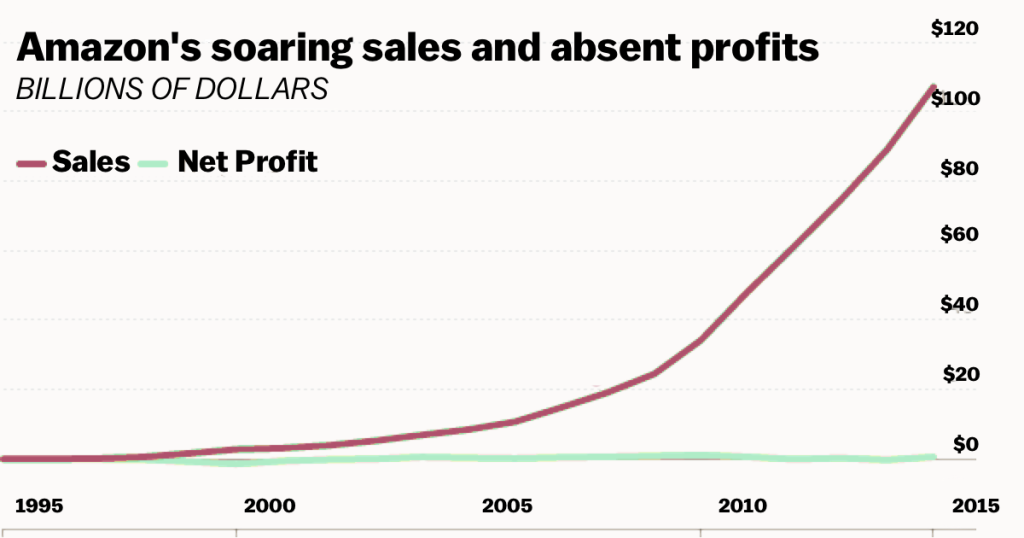

Amazon, a marketplace that continually brings something new to the table (think Amazon Prime, web services, entertainment, smartphones, drone delivery, etc.) is putting their revenue back into the company, a tradition at this point. Just look at this graph:

Image via Vox

With every climb of that sales line, the profit line has barely budged. That money clearly is going straight back into the business. Obviously, no publicly traded company wants to risk the wrath of its investors, so, unless Amazon decides to stop putting those sweet sales back into the business, it has no choice but to cut its costs.

Rumor has it that Amazon is beginning to do exactly that, and their sights are set on shipping. Don’t get me wrong though, they don’t intend to cut back on the many products they ship. Instead, they seem to be putting money into their own logistics capabilities in an effort to reduce their reliance on potentially pricey third-party carriers, like USPS, UPS, or FedEx.

The Root of the Problem

One of the main reasons Amazon seems to be growing their influence in the wonderful world of shipping is because they want to cut down their costs and increase their shipping reliability by fulfilling themselves. In Q4 alone, shipping costs popped up by 37% to $4.17 billion according to the Wall Street Journal. That certainly doesn’t help the margins of a company known for high operating costs, which services like FBA, video and music streaming, and AWS (Amazon Web Services) don’t help to alleviate.

The success of Amazon Prime is another issue that seems to be propelling their larger investments into logistics. Although there are a variety of benefits offered, quick delivery is one of the most appealing aspects that many customers make use of. Problem is, when you’ve got a ton of Prime members clicking the Prime delivery option, you’re going to end up paying third party carriers a lot more money, and that’s exactly what happened in Q4.

The Price of Shipping Business

The first whispers of the company making a larger move towards shipping arrived in mid-December when The Seattle Times reported that Amazon was in the process of negotiating to lease 20 Boeing 767 jets. Call it a curse of success, but ecommerce’s more-than-expected performance over the holidays inevitably led to over-burdened carriers that made the news for their less-than-prompt delivery times.

Amazon’s negotiations raised eyebrows because it seemed to suggest that they were weakening their reliance on those third-party carriers, particularly UPS and FedEx, that failed to meet consumer demands. Nobody wants to rock the freight boat, but it’s a glaring issue for a marketplace that prides itself on effective delivery, especially for Prime customers that pay for it. By putting money into their own logistics, it allows them to fulfill orders themselves during peak times, like the holidays, when other carriers are overwhelmed.

It makes perfect sense, and it doesn’t really pose a threat to the third-party carriers it currently works closely with. But many suspect that it’s just part of the larger picture. Some believe they’re taking steps to build a logistics machine that actually competes with other carriers.

Shaking Up the Shipping Game

And it isn’t hard to see it that way. Just look to the skies – Boeing jets and drones? Amazon’s also taking to the skies in a more miniature fashion with their proposed drone delivery program dubbed Amazon Prime Air that promises an order delivery of 40 minutes or less. Although the program isn’t expected to get off the ground anytime soon, government agencies are already hard at work determining if it’s possible by regulatory standards.

On a more grounded level, they’re also fiddling with a new form of fulfillment called Amazon Flex. Inspired by the “sharing economy” that Uber helped to pioneer, Amazon is hiring drivers in specific cities to deliver packages from Amazon’s warehouses to customers with Prime Now orders. The program was tested in Seattle, where their HQ is located, and apparently it performed quite well. Workers are independent contractors that are paid up to $25, and they can work as they please.

The massive marketplace is known for shaking up industries with new technologies and services. Drones and “Uberized” fulfillment, combined with investments in more traditional forms of shipping seem to point toward them making a more competitive move in the shipping scene.

As Suggestive as It’s Ever Been

Although Amazon has always had a presence in logistics, the prior two endeavors aren’t exactly true-blue shipping. They’re pretty much fetching products and delivering them to customers that are relatively near Amazon warehouses. It’s not the full-blown fulfillment you expect from third-party carriers.

It’s looking like that may change though.

Regardless of all their investments in their own logistics, the most concrete proof so far of their aspirations to become a shipping competitor popped up in writing. In a securities filing just days ago, Amazon mentioned an interesting line for the first time in its nearly 20 year history. When listing out its competition, it included the following:

… companies that provide fulfillment and logistics services for themselves or for third parties, whether online or offline

Sounds a lot like the third party carriers it’s been using for years.

It’s important to emphasize that this is a new phrase they’ve never spoken about before. Still, they’re not at all interested in spooking the carriers they currently rely on, like USPS, UPS, and FedEx. During Amazon’s Q4 meeting with analysts, Amazon’s CFO, Brian Olsavsky already began extinguishing rumors of competition:

In order to properly serve our customers at peak, we’ve needed to add more of our own logistics to supplement our existing partners. That’s not meant to replace them, and those carriers are no longer able to handle all of our capacity that we need at peak. They have been, and continue to be great partners, and we look forward to working with them in the future.

What’s Next

So is Amazon actually just trying to help itself by investing in fulfillment and shipping, or is it preparing to compete? Who knows.

That said, analysts are wary of Amazon’s logistics plans, competition or not. All online merchants get a quick taste of the intricacies of shipping, and full-on entry into the space — whether it’s shipping anyone’s packages or Amazon merchants’ orders exclusively — is sure to bring even larger operational costs that need to be offset.

While it’s not completely confirmed that the marketplace is seeking a greater role in the shipping sphere, it’s at least clear that an increasing amount of their revenue is headed towards logistics. If they do go after a larger role, merchants can be sure that Amazon will bring new services and technologies to the shipping game. In fact, they’re already doing it with drone delivery and Uber-like fulfillment.

Image: Mike Seyfang, Flickr