As we near Halloween, November is terrifyingly right around the corner, and that means predictions for how the holiday selling season will perform. For the past few years as ecommerce continues to expand its growth, we’ve only seen positive predictions that seem to deliver. Will this holiday season hold the same? It’s looking like it.

The Spooky Calm Before the Storm

Halloween isn’t exactly known as being one of the heavy hitting holiday selling times, unless you’re in some sort of spookily seasonal market, like costumes or candy. But it’s still a good excuse to implement promotions and sales to get consumers warmed up for the big leagues arriving in a month.

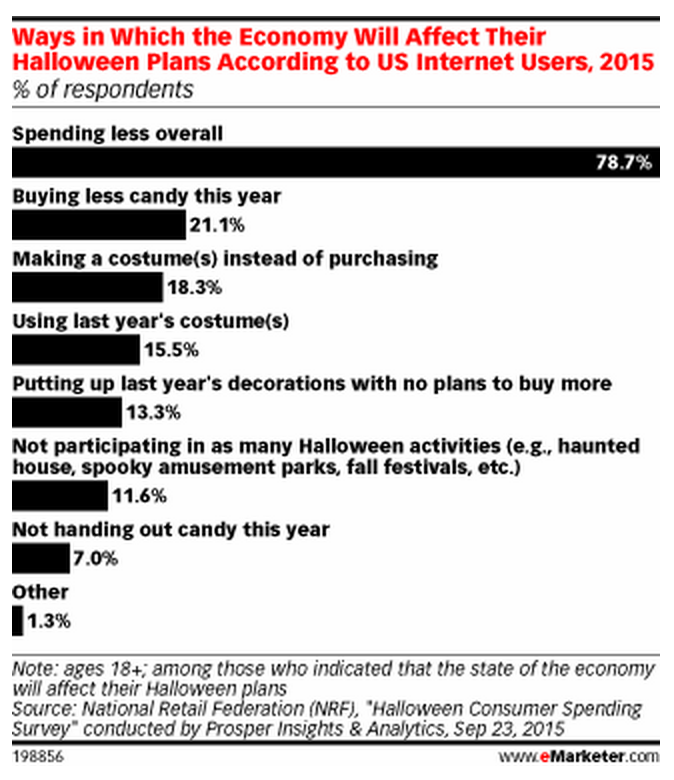

That said, some consumers may be spooked this Halloween season according to market research firm eMarketer. It’s pretty low in any case, with nearly one in five (17%) internet users claiming they would be spending less this year, mostly out of motivation to cut down on costs overall, which was the main reason (78.7%) frugal shoppers decided to shy away from Halloween spending.

Consumer confidence in October also seems to be backing up the slightly timid behavior that eMarketer suggested. While most expected it to rise even further from September’s high mark (102.6), consumer confidence actually dropped to 97.6 according to Business Insider due to less enthusiastic feelings toward the job market. But the vast majority of consumers believe the economy is still in a favorable condition, and spending isn’t always tied to sentiment.

On the flip side, if cautious consumers are saving during the weakest holiday month of the year, they might be prepping for the real deal in November and December.

Setting Aside Some Christmas Cash

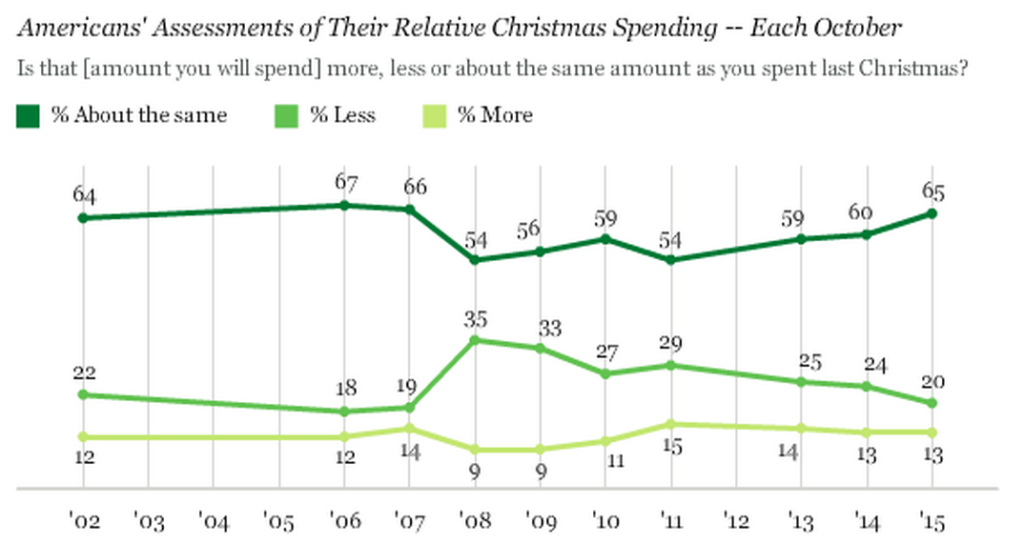

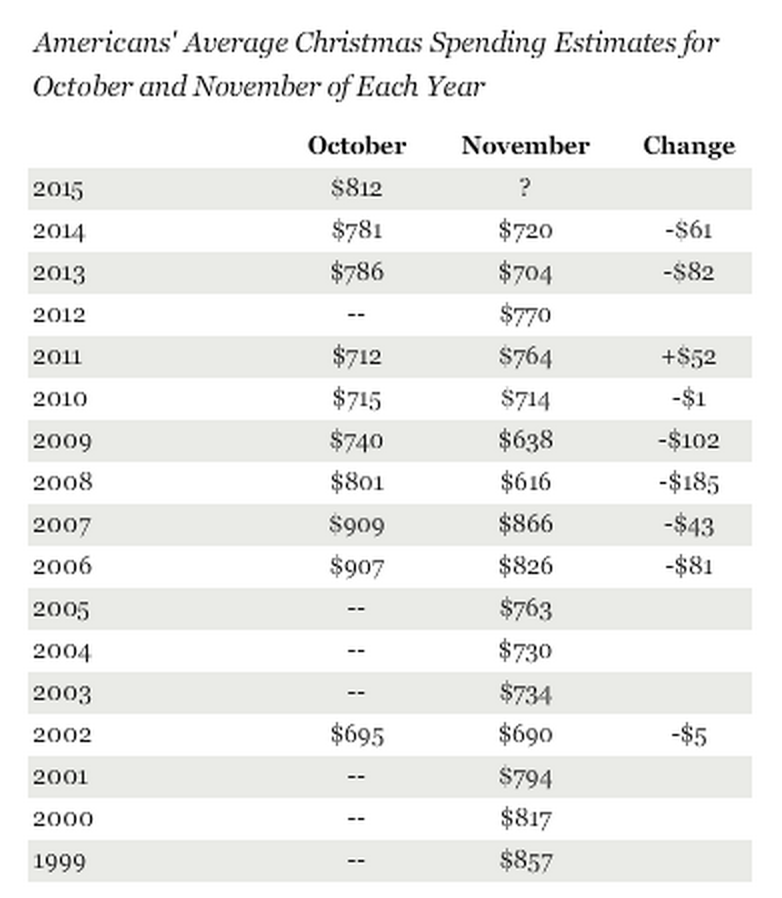

So just how are consumers planning to spend during the ripe holiday season between Black Friday and New Year’s Day? A Gallup poll carried out earlier this month reveals that U.S. consumers’ own spending expectations are the best they’ve been since October 2007 when the market took a turn, at an average of $812. And those vowing to spend less this year are less in number than they’ve been in the past.

You’re probably thinking this is pointless because we’re still a month or so away from the spending splurge, and you have a point. Gallup clarifies that consumers are typically more conservative with their estimates as Thanksgiving week inches closer, but it’s usually a difference of less than $100, and the higher October plans are, the higher the spending later.

Holiday FedExpectations

Another solid way of measuring the holidays’ potential performance is by analyzing shippers’ predictions, since they’re the ones fulfilling everyone’s gifts. And by the looks of it, that little arrow hidden in the FedEx logo should be pointing up.

The shipping company is definitely feeling optimistic at the prospect of holiday sales, planning for a 12% increase in shipments between Black Friday and Christmas Eve. Thankfully for all of us, it’s largely due to growth in ecommerce shopping. They believe a period of three days where package volume doubles – the days between Cyber Monday and the first two Mondays in December – will end up boosting sales over the season.

That’s a somewhat obvious indication that that period between Cyber Monday and mid-December is the selling primetime for e-retailers. And it pretty much falls in line with past years’ results. The heavy weight holiday selling days for ecommerce entrepreneurs tend to be during the two weeks following Cyber Monday. While most people take note of Thanksgiving, Black Friday, and Cyber Monday, the beginning of December is still a major player. Crack open this post highlighting ecommerce industry trends by Bigcommerce for more information on the top online selling days of the holidays.

The Bigger View

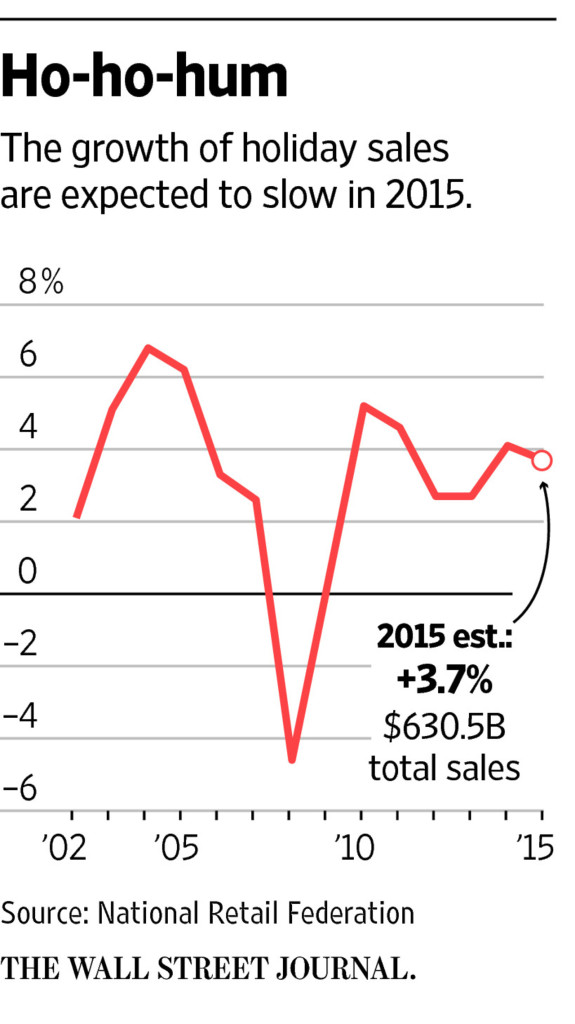

In terms of the broad, overall outlook of growth during the holidays, the National Retail Federation is being cautiously optimistic this year. Overall sales are expected to rise to 3.7% during the festivities, which is just a smidgeon less than last year’s 4.1% gain that the NRF accurately predicted. Holiday sales are to represent an estimated one-fifth (20%) of all sales in 2015, so the holidays are no joke, even if the year-over-year prediction is down by a bit.

The cause for the NRF’s reluctance to predict higher is based on a combination of slower year-over-year job growth (as backed up by consumer confidence), and increased spending on services, restaurants, and gas. But in terms of ecommerce, the NRF is feeling more cheery. Last year, total online sales bumped up by 5.8%, and this year’s expectations are higher at 6 – 8%, reflecting the jolly feelings that FedEx has towards ecommerce.

All in all, things are looking positive. Don’t let Halloween trick you, this holiday selling season is looking to be a treat for all merchants, whether B&M, online, or both.