This is a shoutout to all of the purchase orders out there, the unsung heroes of inventory that make life so much easier for e-retailers. Most merchants consider them to be life savers in terms of inventory management, but they’re also hugely useful for managing relationships with suppliers, optimizing the supply chain process while potentially protecting you from harm.

Invaluable for Inventory Management

There is no doubting it, Purchase Orders (POs) are instrumental when it comes to handling inventory. Getting product from your suppliers is obviously a pretty important part of selling, and POs are what make it happen.

The Pieces of a Purchase Order

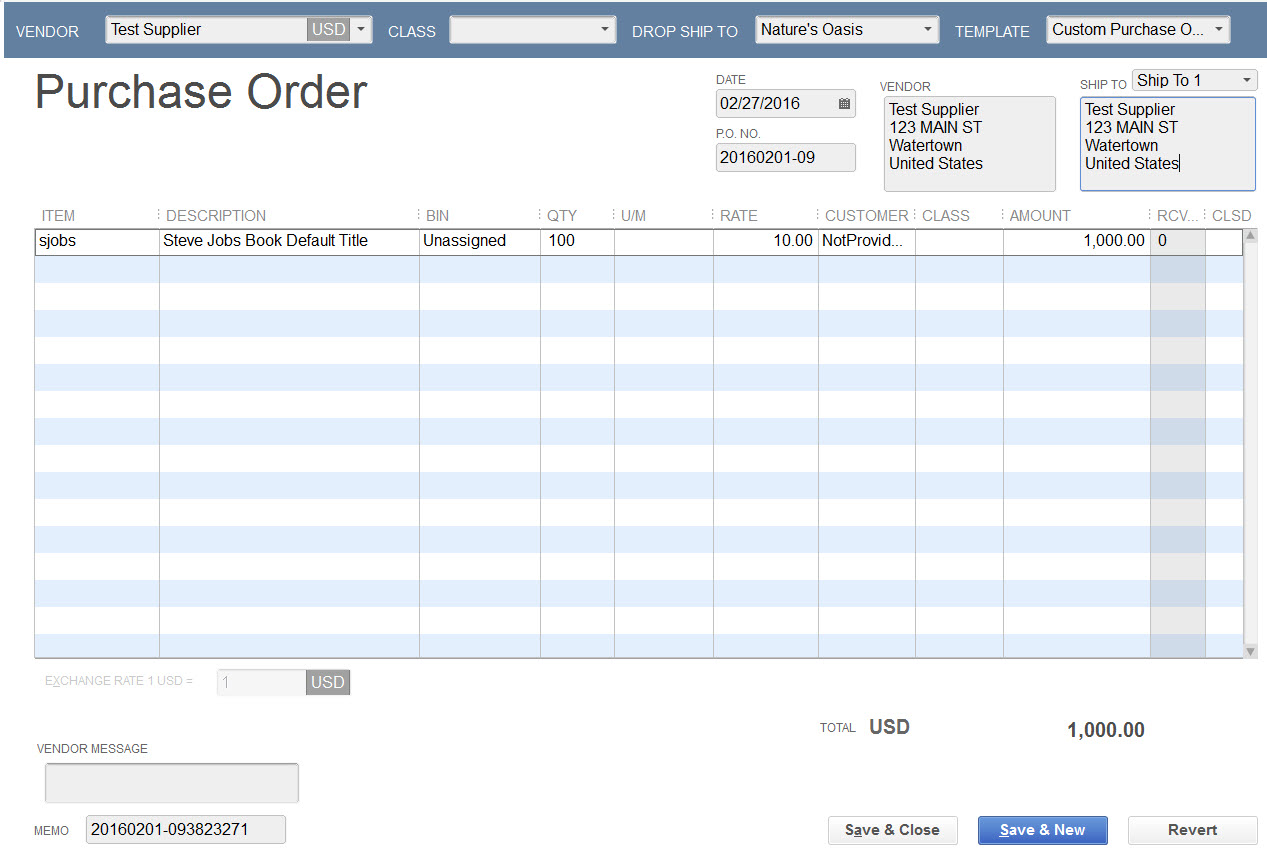

By definition, a PO is a document sent from merchant to supplier that orders some quantity of product carried by the supplier. It generally contains the following:

- Your name, date, and company address

- Your supplier’s name and address

- Ship to information

- Specific products you’d like to order, including product size, color, etc.

- Price per unit

- Quantity requested

- SKUs and product IDs

Keep in mind, the more specific you are in your PO, the less room for any miscommunication with your supplier. They come in all shapes, sizes, and forms, but here’s a picture of what a PO tends to look like:

The Quintessential Questions

When you whip up a PO, ask yourself the following questions:

- Is my current inventory susceptible to a stock out?

- How much does each unit cost?

- How many have I sold?

- Am I waiting on backordered inventory (remaining inventory on the way from a previous PO)?

- How much product do I need to buy?

- How much will this PO cost in total?

These are basic questions that make sure the PO meets your demand and balance sheet. After it’s all wrapped up, it’s sent to your vendor, who looks it over and determines if they can fulfill your request.

Plenty of software is out there (including us!) allowing a merchant to handle purchase orders within an app. With inventory management solutions, you’re able to create, issue, and print POs, speeding up the process and making it very easy to track your purchase and inventory history.

But enough of the sales pitch.

Protecting Your Assets

Business relationships are everything, and POs are a major part of your supply-side relationship. If you’re relying on a vendor to stock your products, your mutual partnership with them is obviously critical to both your businesses.

But let’s face it, relationships can have bumps. How you handle POs can clarify and protect your relationships with suppliers in the event that a transaction goes awry.

Acknowledge the PO

Sure, POs are mostly created for letting your supplier know that you’re ready to restock some of your inventory. But they’re a little more than that. With every PO you issue, you’re sending a proposal to your suppliers that you’d like to enter a brief sales contract.

Documents are far more important than people let on. They document things (shocking, I know!), and can be referenced in the event that something goes wrong. You should document all of the transactions between you and your suppliers as a contingency plan in case a dispute arises, and your PO does just that.

Let’s say your supplier sends you 20 units less than you requested in your PO, so you aren’t going to fork over any cash just yet. Reference your PO for confirmation that they didn’t meet your request. If they’re 20 under the quantity requested and they dispute it, shove the paper in their face. The PO exists as proof of exactly what you expected from your supplier.

Don’t Confuse the PO

But it’s not over yet, POs have another closely related, but different counterpart you’re probably familiar with: the invoice. A PO is not an invoice — that’s a disrespectful insult! The PO is essentially the proposed contract of a sale, and an invoice confirms it.

Although POs and invoices share pretty much the exact same information, like the specific products requested, the quantity for purchase, and the address of both merchant and supplier, each is sent by different parts of the relationship, merchant and supplier respectively.

An invoice is a supplier’s response to the PO. It highlights what exactly they will sell to the merchant, and exactly how much they need to be paid as a result. Here’s a chart that slots each:

| Purchase Order | Invoice | |

|---|---|---|

| Meaning | Purchase Orders order goods from your suppliers | Invoices indicate payment needed for the goods being sold |

| Sent by | Merchant | Supplier |

| What it does | Acts as a contract of sale | Acts as a confirmation of sale |

Backtracking to the example we spoke of earlier, where the supplier sends you less quantity than was requested, check the invoice. In it, if the quantity they’re requesting payment for is actually 20 units less than expected, you’ve been shorted by the supplier, and there’s nothing wrong with it. Your supplier just doesn’t have enough inventory on hand to meet your entire request yet.

If the invoice matches your PO, you’re still 20 short and there’s no backorder arrangement (when the supplier sends the product in chunks over time to meet your PO), then you’ve got a problem. That’s obviously a bad supplier. Now you’ve got other, more litigious, options on the table.

Why Should I Even Care?

Let’s avoid all that legal nonsense — this is about POs, not POS lawyers!

At the end of the day, you shouldn’t have to resort to looking at the ins and outs of your POs to use them as a protection; you should never be constantly paranoid that your supplier pulled something over on you.

Supply-side relationships are the steel cables keeping your supply chain in line, ensuring that product is reliably available to meet your demand. If you find yourself in a snafu with one of your vendors, consider finding an alternative supplier, or communicate with them to hash out some sort of agreement.

A Standing Ovation

Just for emphasis, POs are ultimately all about getting products from suppliers efficiently, and keeping inventory and costs organized effectively. We owe POs much for how they solve our inventory woes, and protect us from any potential foes.

I love POs.