A decades-old staple of American commerce is quickly becoming history: one by one, malls are shuttering their doors, and somewhere in the United States a warehouse opens its own.

At the core of this movement is ecommerce.

A Bigger Chunk of the Pie

Over the course of the next few years, a third of all American malls are expected to close. It’s no big secret why — consumer purchases are moving from offline to online at an ever-increasing rate, and it’s often at the expense of retailers. Slowly but surely, online retail sales are biting chunks out of total retail sales, and traditional retailers are forced to adapt.

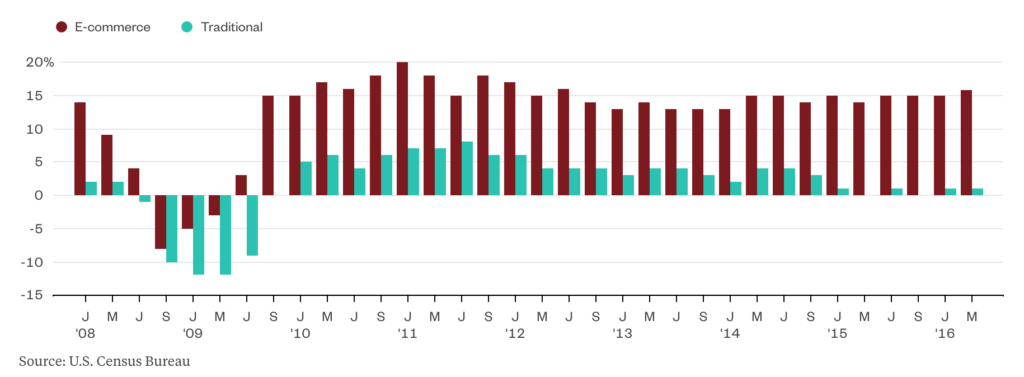

The U.S. Department of Commerce has consistently reported year-over-year growth in online sales; last quarter nearly hit 16% — the highest in two years — with online sales accounting for nearly 12% of total retail sales at $97.25 billion.

This trend has been going on for a while now — growth in ecommerce has consistently hit the double digits over the past eight years since the Great Recession. But traditional retailers, after experiencing bursts in growth post-2009, are struggling to maintain it. Bloomberg provides us with a better illustration of the tremendous growth in ecommerce over the years, often at the expense of offline retailers:

As for the future, eMarketer expects the trend to continue over the several few years. At a global level, online retail sales are predicting to continue expanding by the double digits; growth rates will remain high, descending over time as ecommerce’s slice of the retail pie ticks upward.

It should be noted, however, that much of the wealth being generated by ecommerce is falling into the hands of a certain marketplace: Amazon. According to Business Insider, 10% of growth over the last half-year both offline and online went to the marketplace.

That’s a significant chunk, and, although they may be a little late to the party, retailers are beginning to recognize that omnichannel — when a business is equal parts offline and online — is the emerging landscape of retail. Everyone else definitely does.

Where Are the Warehouses

For all the standard reasons — crowds, transportation, hatred of teenagers — consumers are ditching malls, even retail’s brick and mortar locations, and moving online to browse and purchase. And as the online space expands, space for storing and fulfilling online orders must do the same.

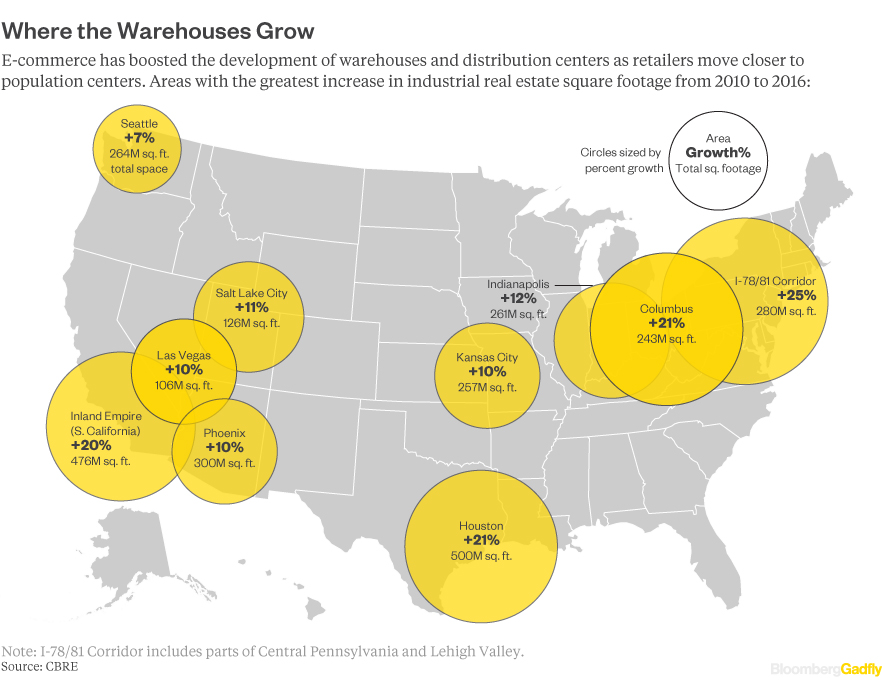

Different types of large, spacious buildings are replacing malls across the nation. Growth in the amount of warehouses and distribution centers is already in full effect.

Warehouses are popping up and getting larger, particularly in populous areas where orders can be shipped most efficiently in terms of time and cost:

Rising Costs

“If you build it, they will come” is absolutely true in the case of warehouse and merchant, especially as ecommerce takes off. But higher costs are arriving as well.

In population-dense areas, like the West Coast and New England, rental rates are jumping up, rising nearly 30% year-over-year as e-retailers flock to well-located 3PLs (third-party logistics providers) for storage and fulfillment. Warehouses are expanding and being built to meet the demand, but, in the meantime, rates are spiking.

Amazon’s very own fulfillment service, Fulfillment By Amazon, is also following the trend, planning to raise fees beginning in October as the holiday season approaches. It’s a warning to the many e-retailers interested in the service; Amazon is essentially telling them to only store in-demand products that get off the shelf quickly or face greater costs. The more products they fulfill, the more money they make, and space is limited.

Ultimately, the rise in costs can be attributed to the growth in use from e-retailers of all sizes, whether it’s a mammoth like Macy’s or your average e-retailer. But the escalation in costs around population centers is tied to the very reason warehouses are being built there: shipping.

With so many consumers in an area, many of which demand rapid delivery at the very least and free shipping at the most, online-only and omnichannel retailers are willing to fork over the extra cash to store and fulfill orders via nearby 3PLs.

Inventory Matters

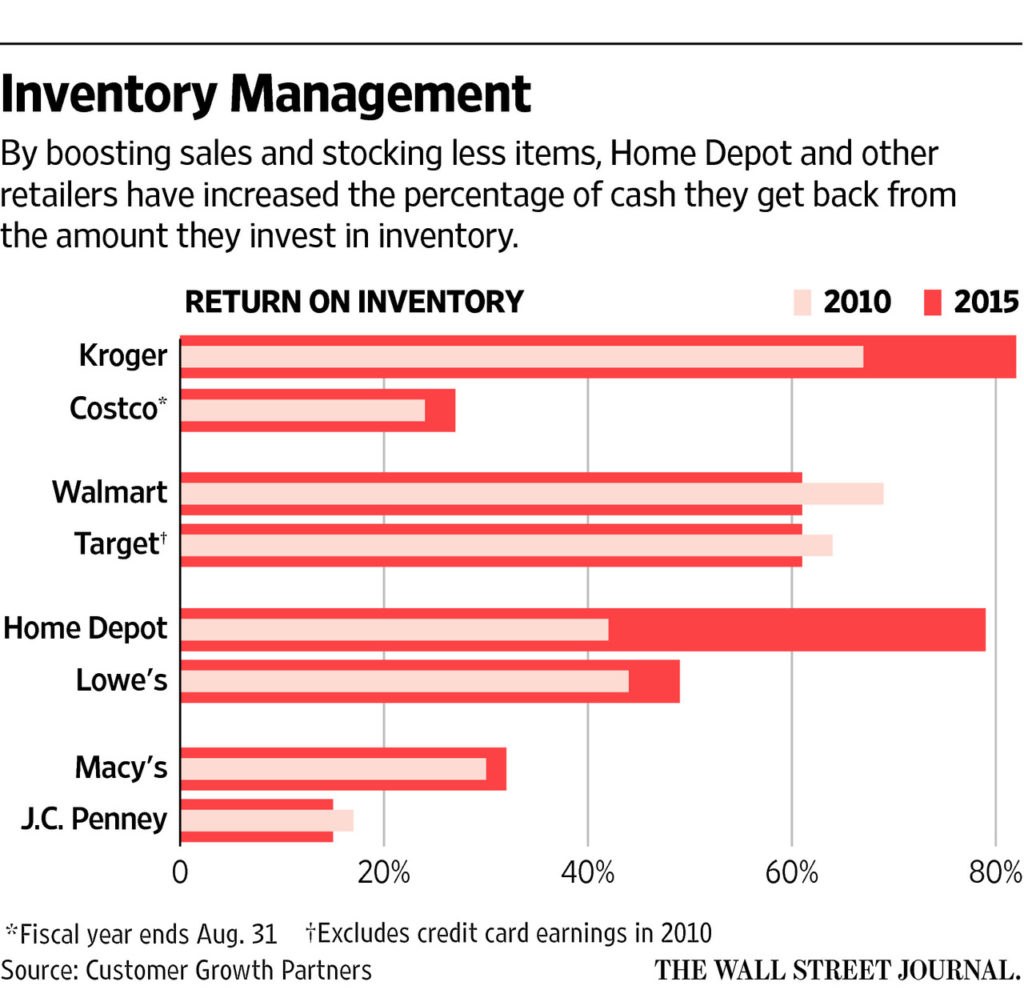

Naturally, inventory is inherently related to warehouses. As retailers begin straddling offline and online, storing products in their brick and mortars and third-party warehouses simultaneously, issues have sprouted up.

If retailers were to store and ship their online orders via 3PLs exclusively, inventory — the greatest expense of a business that ties up cash — would increase dramatically. Having two loads of inventory, some in a warehouse and some in a physical store, is too much risk and too expensive.

Some retailers have found success turning the back offices of their stores into fulfillment centers that pick, pack, and ship orders using inventory stored there. It’s especially useful for cutting shipping costs, but it’s also more man-hours, i.e. higher employment costs.

Currently, omnichannel retailers, especially larger ones, have settled with selling more, stocking less, and restocking more. By selling online, they’re able to increase order volume; by storing less inventory, less cash is tied up; by resupplying more often, they keep a steady flow of inventory.

Image: Brett Levin, Flickr

Image: Brett Levin, Flickr