When we start seeing all the holiday shipping cut-offs, we know it means the year is wrapping up. All in all, it’s been a great year for ecommerce. Companies are continuing to innovate fresh ways to sell and ship online orders. Apple is pushing their Apple TV as a selling platform, and social media continues to advocate for social selling. On the fulfillment side, there have been moves to change up how products get from A to B, with businesses like Shopify / Bigcommerce partnering with Uber, and Amazon pursuing drone 30 minute delivery.

But who cares about all that stuff, the past is the past. Let’s look to the future and take some well-educated guesses at what’s in store next year for ecommerce.

Mobile Matters

If you were to look at a chart showing mobile usage related to ecommerce, the line would be far from immobile, traveling upwards and upwards. Without a shadow of a doubt, the holiday selling gauntlet a couple weeks ago showed that mobile channels not only drive a huge chunk of traffic (more than half throughout the holidays), but they lead to sales as well.

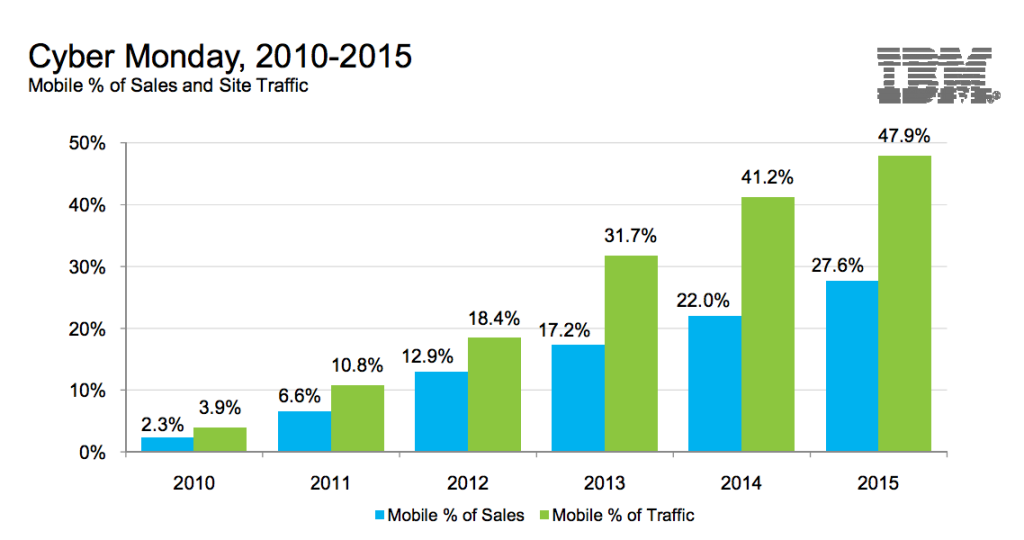

Although mobile traffic was considerably high this year, mobile’s conversion rates were a tad too low in comparison. Using the the IBM’s report on Cyber Monday (which actually had less mobile traffic than Thanksgiving and Black Friday) as an example, we an see mobile traffic climbing far more quickly than actual sales:

Given the dramatic rise in mobile traffic over the past five years, lower conversion rates are no surprise – getting consumers to your site is only the first step. But as more and more of them begin to use their mobile devices to search and mobile wallets to buy, conversion rates are likely to improve.

Forget About Cheaper Fulfillment

If only fulfilling orders was as cheap as gasoline these days. You would think cheaper gas would mean cheaper costs to ship, right? Not by the looks of it.

All major carriers – USPS, UPS, and FedEx – are upping their costs come 2016, or already have, as is the case for the latter two (we’ll have information on the USPS changes closer to when the changes go live on January 17). Considering the rise of ecommerce and significant increase in online orders, especially over the holidays, carriers are putting in more work. Success is such a curse.

Amazon’s Fulfillment By Amazon is also opting to tick their rates upwards for many of the same reasons – changes in storage costs, fulfillment, etc, likely due to greater order volume. Their changes won’t take effect until mid-February, so stay tuned for their specifics as well.

The good news? For many ecommerce retailers, all these rate changes won’t be too significant of an impact on the bottom line. Retailers shipping large, heavy products will feel the majority of the changes, but those fulfilling products at around a pound (16 oz) will likely not notice it too much. Don’t panic, though. Again, we’ll be covering all the changes to USPS in much, much greater detail in the coming weeks, and we’ll tackle FBA after that.

APAC’s Appeal

APAC stands for the Asia-Pacific region, and it’s becoming quite the market for ecommerce. Online sales have risen 35% in China alone, and cross border ecommerce had an even larger increase of 90% over 2015. Why? It’s a huge market, and APAC consumers tend to be more tech-savvy than North Americans. To add, they also have an interest in American products. But we’ve covered all this before, so skim over our APAC and ecommerce post for more.

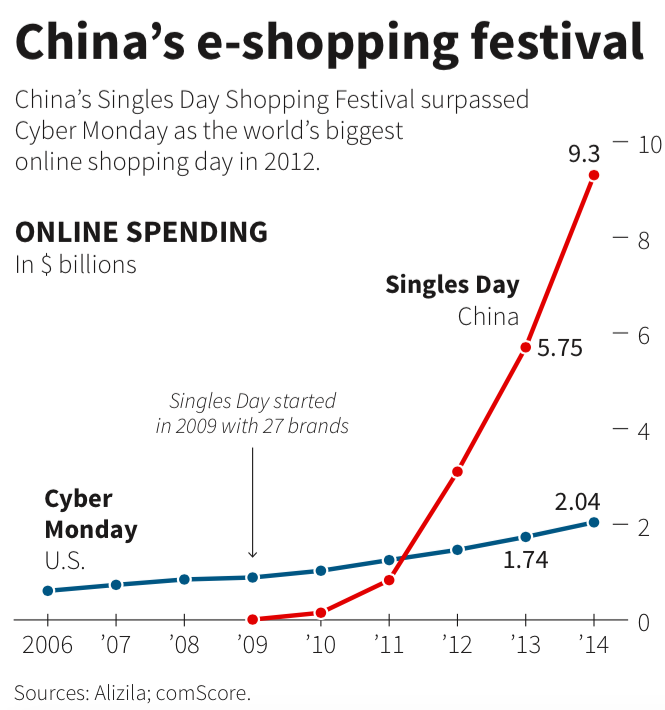

To drive the point home, Singles’ Day in China turned out to be a blockbuster this year as well, racking up $14.3 billion in a single day for Alibaba, a Chinese marketplace similar to Amazon. Take a look at the below chart from 2012. That red line is even steeper than the predictions from back then.

Thanks to China’s huge population, promotional tactics, and a willingness to buy online, the day was an absolute blowout. More and more brands are taking notice as well, and it wouldn’t be surprising to see increasing amounts of merchants digging their way to China, opening up sales channels there in 2016.

Multichannel More Than Ever

Sales channels more than anything illustrated the power of ecommerce this year.

Two of the fastest growing selling fronts – social media and mobile – combined to create at-the-ready selling channels on merchants’ social media. Facebook has pushed its own “buy buttons,” Pinterest acquired two mobile oriented businesses in an effort to build out shopping, and Stripe and Twitter partnered some months ago to disperse their own “buy buttons.”

We’ve also got our eye on a new sort of commerce. First it was e-commerce, then m-commerce (mobile), and now.. t-commerce? It’s clear from Apple’s main event in September that they intend to turn Apple TV into it’s own app platform and selling channel. They emphasized the smooth purchasing capabilities of the device, and there are hints that it could become an advertising machine – combining purchase history with entertainment preferences and in-app ads.

It’s true that where there’s an internet connection, there’s an opportunity to sell, and we’re looking forward to seeing what next year entails for ecommerce, especially considering this year’s success. When you sing ‘Auld Lang Syne’ as the New Year approaches, you should plan for more gold online in 2016.

Image: John Haslam, Flickr