A major synonym for ecommerce is Amazon. They’re a behemoth of a company. From web services to smartphones to video game livestreaming, the marketplace is involved in as many industries as they have products (that may be a hyperbole). But on the online selling side of life, they’re showing some major changes in lieu of ecommerce’s rapid growth.

Let’s dissect some of the significant moves the marketplace is making, along with what they might mean for the ecommerce market and small and medium-sized merchants.

Shoehorning Shipping

A little more than a half a year ago, we spoke about how Amazon seemed to be morphing into a shipping carrier. That’s all but confirmed now.

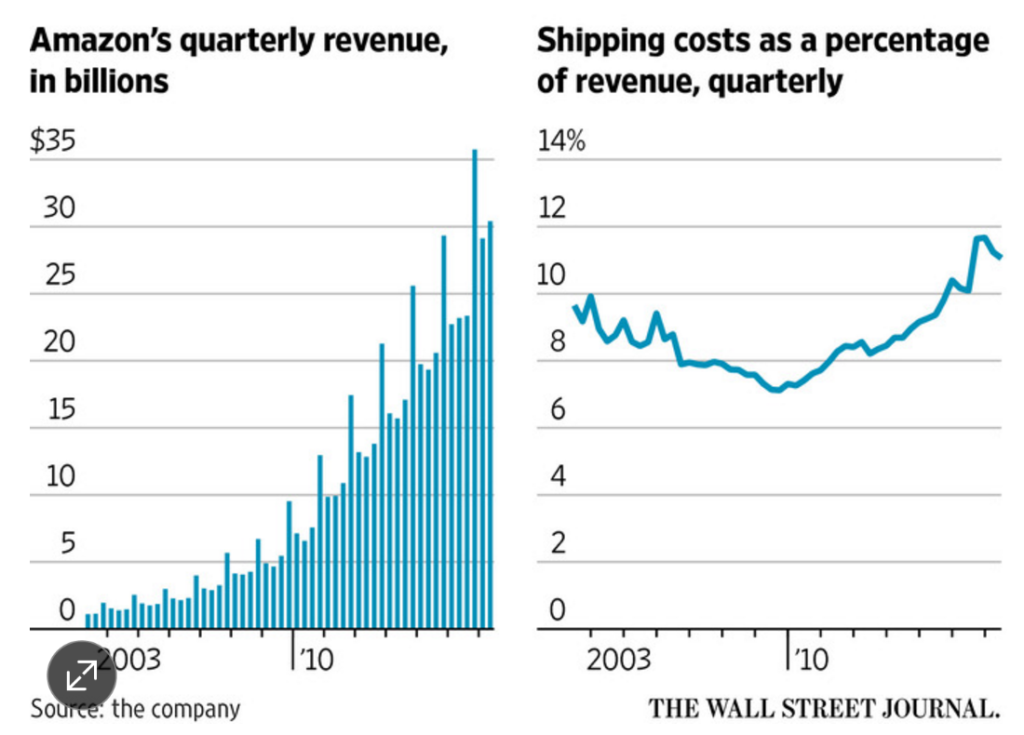

To fend off any accusations that they’re revving up to fight carriers like USPS, FedEx, or UPS, Amazon has always justified their recent investments in shipping and logistics as a means of better fulfilling their massive order volume. And that may very well be the root of Amazon’s shipping aspirations; shipping costs are enormous, accounting for a hefty chunk of their revenue:

Reducing them is a prerogative, and by beefing up their operations, they’re able to reduce their reliance on third-party carriers that cost them money. Add their many warehouses into the mix, their arsenal of trucks and Boeing planes, and their drone push (which we’ll get to later), and you’ve got the means to take fulfillment on for yourself.

Part of it leads back to their original point that they simply don’t want to rely on third-party carriers as often. Nearly every holiday season over the past few years has failed to properly prepare for the avalanche in demand. FedEx was swamped and UPS had a tough time last year, which in turn put a strain on Amazon’s ability to deliver on time, and pushes them to invest more into their logistics.

And that’s the risk that third-party carriers are seeing. Not only does Amazon account for much of the orders made online, they’re gaining the means to fulfill them themselves, cutting out the need for paying and relying on such carriers.

Still, third-party carriers scoff at the idea that Amazon could pull off the enormous investment required to properly ship like the big guys:

The level of global investment in facilities, sorting, aircraft, vehicles, people to replicate the service we provide, or our primary competitor provides, is just daunting, and frankly, in our view, unrealistic. We’ve been at this for 40 years. — FedEx CFO Alan Graf.

And there is a point to such a comment. FedEx reported more than $4.3 billion in capital expenditures (costs related to buildings, trucks, equipment, etc.) last year. Amazon certainly makes a killing that’s in the billions, but skepticism over their ability to truly compete with established carries is reasonable. Regardless, the foundation is being laid for them to do so.

Droning On and On

Although some progress has been made regarding drone regulations — like which types of businesses can employ them, when they’re allowed to use them, and for what — MIT technology review is not too optimistic about Amazon (and other carriers’) plans to offer drones as an option at the checkout page.

Plenty of businesses are already out and about using drones to accomplish a variety of tasks, from inspecting power lines to delivering food. But package delivery faces quite a few hurdles (think security, reliability, and privacy), making it an uphill regulatory battle that will likely be decided somewhere around 2020.

Interestingly, however, drones may just be part of the bigger picture for Amazon. A New York Times report argues that Amazon has no interest in truly competing with the major third-party shippers that crawl around on the ground. Rather, they want to ditch the asphalt and head to complete autonomy in the air. No congested streets and gas-chugging trucks. Although they’ve purchased several jets for aerial delivery, drones open up an entirely new automated channel for delivery that’s less than 400 feet in the sky.

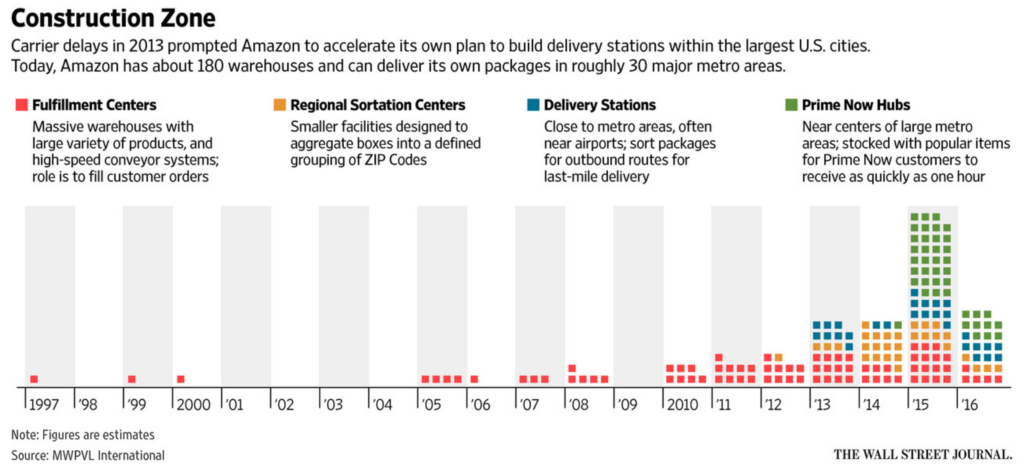

Combine that with a rapidly growing amount of warehouses (see below) — nearly half of Americans are now within 20 miles of an Amazon facility — that are are already or have the potential to be automated, and you’ve got cheaper, more effective ways of delivering that will inevitably pressure carriers and retailers to work or compete with Amazon.

Countering the Counterfeits

In a pay-to-play move, the jungle of a marketplace has begun charging new third-party merchants with one-time four-digit fees to sell specific brands like Nike and LEGO on the marketplace. This has less to do with gouging newly-arriving sellers with a barrier to entry and more to do with appeasing big brands that are getting very irritated with the number of counterfeit products on marketplaces.

Take Alibaba, for instance. They’re under heavy pressure from brands for the amount of counterfeit products sold on the marketplace, and U.S. agencies like the U.S. Trade Representative are threatening to place them on the naughty list. By slapping a hefty fee on new merchants hoping to sell brands, Amazon’s ensuring that the seller is committed to straight commerce, not counterfeiting.

Some merchants, existing and new, are skeptical of the fees, fearing that the rapidly-expanding marketplace is transitioning away from resellers and middlemen in favor of brand owners and manufacturers. It’s a perfectly reasonable fear to have. As larger and larger amounts of traffic head their way and retailers struggle to get their online operations running, the marketplace has become an opportunity for big brands and — for Amazon — big money.

Cracking Down on Pages

As its popularity runs parallel with ecommerce’s growth, Amazon has had to crack down on more than just counterfeit goods. It’s no big secret that one of Amazon’s defining characteristics in its beginnings was its deals; that little price point with a slash through it and a bargain below. That’s changing.

In recent years, Amazon has begun to reduce any mention of a list price, according to the New York Times, and much of that is due to threatening legal pitfalls that it’s falsely advertising. In many cases these days, there’s a single available price on products — no wallet-salivating bargain from a list price.

That’s because Amazon’s list prices have often been labeled as marketing mumbo jumbo. The list price is essentially the MSRP (manufacturers’ suggested retail price), and by showing it to the customer while offering a more appropriate price, they’re able to make it seem heavily discounted when it may not be discounted at all.

Legal action has consistently hit Amazon for fake-discounts, and they’re hoping to reduce legal threats by gradually shedding list prices. Unfortunately, this has caused problems for some sellers that rely on the list price and subsequent discount — significant or not — as a marketing tool.

Amazon probably isn’t worried, though. List prices were a major part of the marketplace’s old way of developing growth. Historically, Amazon utilized them to appeal to price-sensitive customers that weren’t accustomed to purchasing online; the deals — legitimate or not — help grow order volume which offset any losses. By and large, that strategy doesn’t matter as much thanks to the fact that they absolutely dominate ecommerce, a market that’s only going up.

Reviewing the Reviews Policy

Another major change only recently arrived to the marketplace: no more incentivized reviews.

Social proof in the form of reviews remains invaluable when selling online, even more so when selling on Amazon. Those five stars alone can act as the doorway to a consumer’s purchase decision before they even check out the price. Less than four, and that door may just close immediately, making positive reviews essential.

But the review system can be gamed, and Amazon has a history of shady reviews practices. Although they’ve forbidden paid reviews, a loophole existed allowing sellers to offer reviewers products or discounts so long as the review wrote an honest review that made it clear the review was part of an exchange with the seller.

Naturally, the transaction immediately tainted an honest review. But don’t take a qualitative word for it — look at the studies. An analysis of these incentivized reviews shows an average rating that’s consistently higher than that of your average, non-incentivized rating.

Like their fight against counterfeits, Amazon is buckling down on cutting out any unfair practice negatively affecting both a consumer’s purchase and a seller’s performance. They’ve banned the practice of incentivized reviews, although they won’t be scrubbing any existing reviews unless they’re over-the-top.

Image: Stephen Woods, Flickr