There’s a twinkle in the eyes of e-retailers and a little bit of sweat on their brows these days. On the horizon is the holiday season, and with it comes (hopefully) a flood of revenue and a lot of work.

But as merchants get down to business developing email marketing campaigns, prepping their inventory, and setting their shipping practices in stone, researchers are crunching the numbers, calculating just how much ecommerce is expected to grow this year.

October is the month when those predictions arrive, and we’ve got three of ’em that differ on the exact percentage, but agree on the direction of growth: up.

The National Retail Federation

Ecommerce’s year-over-year growth: 7 – 10%

Overall online revenue: $117 billion

Traditional retail’s year-over-year growth: 3.6%

Overall retail revenue: $655.8 billion

The NRF, as usual, is playing it a little safe with their performance predictions. But safe to say, there’s going to be growth.

Let’s not forget about Halloween, though. It’s the major holiday between now and the end of November, and NRF is expecting it to be just as successful, with nearly 22% of consumers heading online to purchase. Overall, the spooky spectacular is expected to haul in $8.4 billion, growing at 12% year-over-year.

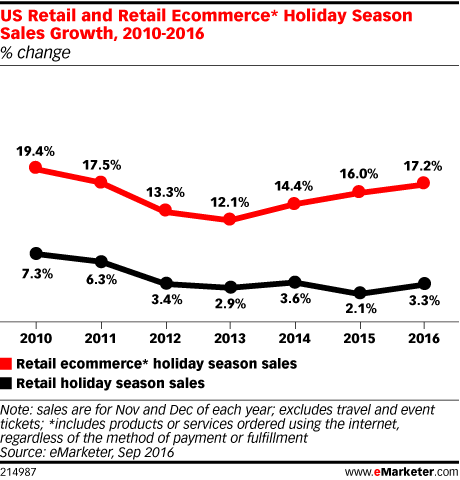

eMarketer

Ecommerce’s year-over-year growth: 17.2%

Overall online revenue: $94.71 billion

Traditional retail’s year-over-year growth: 3.3%

Overall retail revenue: $884.5 billion

eMarketer is in the middle of the road when it comes to predictions, but they’re quick to note that Amazon will likely suck up hefty portion of ecommerce sales, noting that the marketplace made up more than a quarter of all online sales last year.

The marketing research firm also expects mobile to be a primary driver of ecommerce’s success this year, just as it was last year. They’re predicting a 43.2% jump in mcommerce sales, with smartphones gobbling the majority of mobile device purchases, at 58%.

Deloitte

Ecommerce’s year-over-year growth: 17 – 19%

Overall online revenue: $96 – $98 billion

Traditional retail’s year-over-year growth: 3.6 – 4%

Overall retail revenue: >$1 trillion

Deloitte, although slightly more optimistic than the others, is more or less in line with everyone’s expectations. But they also stress that the influence of digital — whether it’s a smartphone, laptop, tablet, or desktop — will impact 67% of purely retail store sales.

Long story short, ecommerce’s growth is between 2X and 4X fast as traditional, in-person retail. It’s a promising sign with no sign of slowdown — be sure to prepare your inventory for a modest bump in order volume!

And as a bonus, Radial and CFI Group have put together some results on their survey of U.S. consumers’ intended behavior when shopping online over the coming months. Their credit cards are at the ready, but plenty of sites are vying for their attention. Take a look at some of their findings to get an understanding of what these demanding customers demand:

- 81% of shoppers will smack the back button or a red X if they see that one of your products is backordered or out-of-stock

- 77% of dissatisfied shoppers are not shy about sharing their poor shopping experience on social media

- 83% of shoppers are strong and independent; they’ll select a self-service option for assistance if needed (get those FAQs ready)

- 71% of shoppers prefer that their orders arrive within 5 days max

- 91% of shoppers are willing to fork over more money to access free shipping