It’s post-New Year’s and the holiday season is a wrap. But let’s revisit the thick of it — the five day long gauntlet between Thanksgiving and Cyber Monday.

We’ve got a few studies and a couple researchers painting the performance during those days, and, rest assured, it’s pretty looking. Here are some of the notable events that happened during those high-selling days.

Cyber Monday Holds On

For a while now, Cyber Monday’s status as blockbuster-online-buying day has been threatened by a holiday that comes three days before it. With every passing year, less consumers are swarming the streets on Black Friday. Instead, they’re staying home, browsing for deals and buying gifts, all while watching YouTube videos of Black Friday hordes.

This year, Cyber Monday held on for dear life as Black Friday moved closer to defeating it.

According to Adobe, Cyber Monday beat out Black Friday by only 3.3% industry-wide, raking in $3.45 billion — a number that surpassed last year’s Cyber Monday by 12.1%.

Their results for Black Friday’s performance come out at $3.34 billion, up 21.6% year-over-year. That’s an impressive jump, backing up predictions that the holiday will eventually turn into Cyber Friday in the coming years.

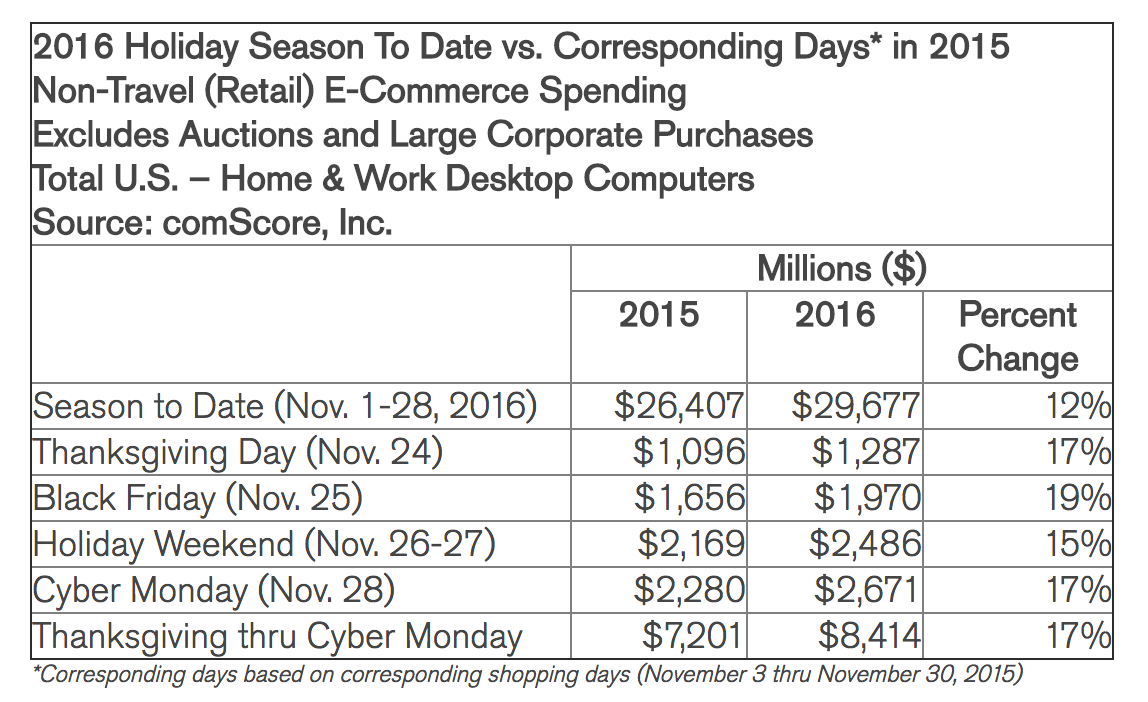

From a different study by comScore, Cyber Monday pulled in $2.28 billion, growing by 17% year-over-year. Black Friday reaped a lower amount of sales but grew by larger margins, ending up with $1.6 billion in online sales, with a jump of 19%.

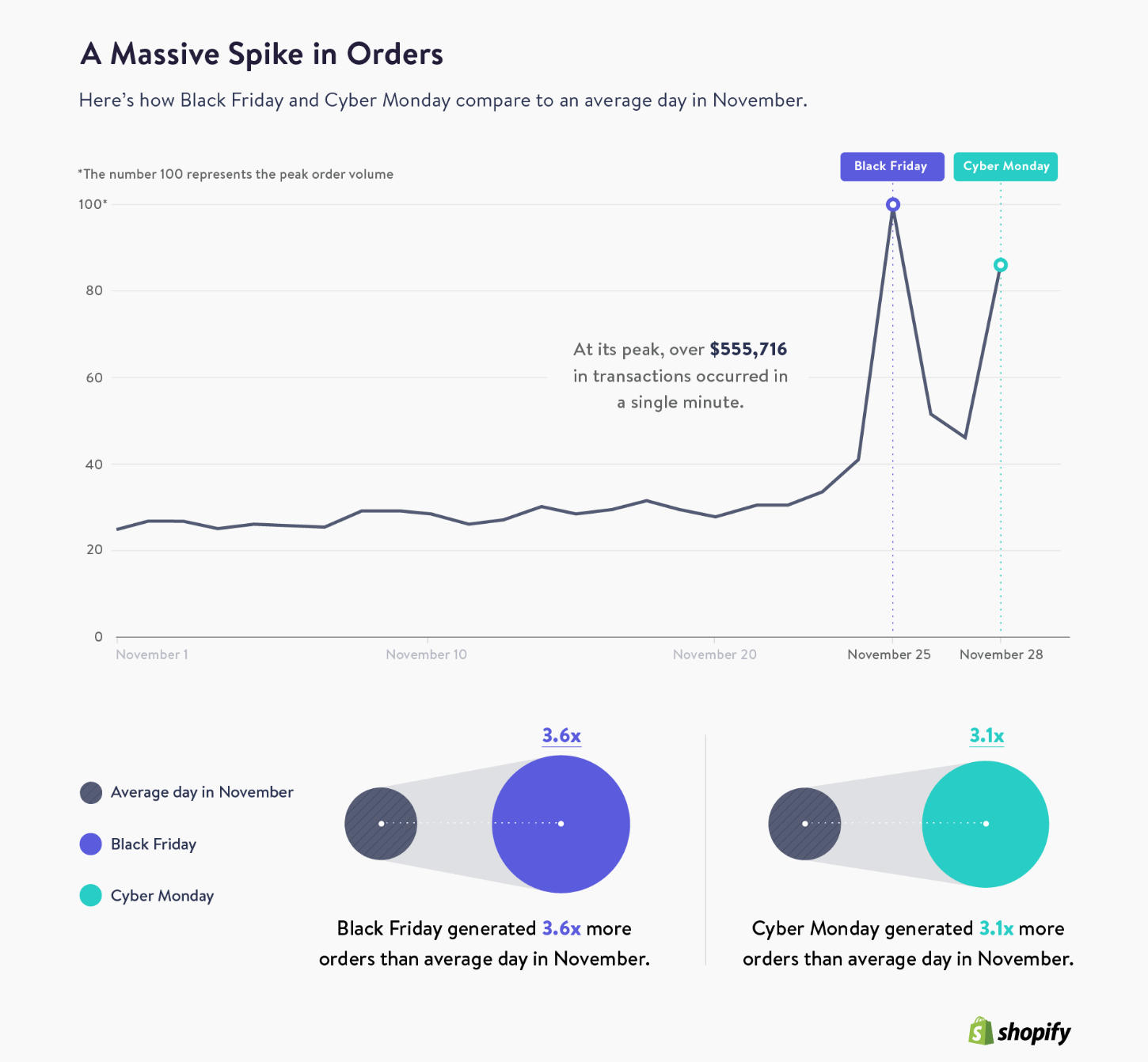

It’s looking like Black Friday will eventually become our new Cyber Monday, the designated day for online selling. Pulling data from their many merchants, Shopify took a look at order volume on both days, finding that Black Friday marginally exceeded the performance of Cyber Monday on Shopify stores:

But hey, regardless of which holiday wins in the end, both are wins for e-retailers.

Thanksgiving Matters

Of course, it’s important not to forget about the day of thanks, a day when consumers are highly likely to be browsing — and buying — online as they sit around with family. As is the case with Black Friday, more consumers opted to buy online than offline, and in greater numbers this year:

The NRF’s research is also backed up by RetailNext, which saw a 4.7% drop in in-store sales and a 5.1% drop in traffic.

Here’s a rundown on Thanksgiving’s performance by our two primary researchers, Adobe and comScore:

Adobe = $1.93 billion at 11.5% year-over-year growth

comScore = $1.29 billion at 17% year-over-year growth

Given its growth in ecommerce over the past few years, it’s clear that Thanksgiving remains a big player in ecommerce over the holiday gauntlet that can’t be discounted. Oh, and if you’d prefer a collective look at each day’s performance and growth, check out this chart:

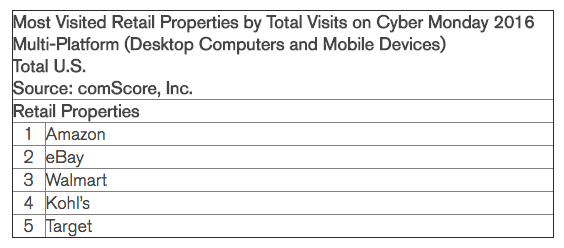

Unlike Cyber Monday’s shaky standing as top day for online sales, Amazon is cementing its place as a top channel for sales.

Multiple studies confirm that it sucked in most of online holiday traffic, accounting for a hefty chunk of sales. Ranking the big winners, comScore placed Amazon on top:

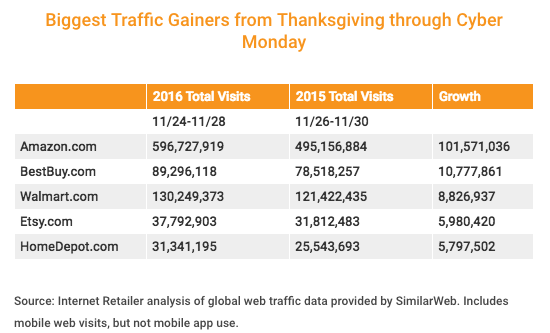

Internet Retailer seconds comScore’s ranking — their analysis of web traffic shows major increases for all large marketplaces and sales channels, but Amazon takes the cake… a huge slice of the cake, in fact:

Of their top 100 sites — one hundred online storefronts that they track — traffic grew by 14.3%. But Amazon gobbled up 57.6% of that growth. It’s clearly an essential channel for many e-retailers.

Mobile’s Trajectory

The rise of mobile has been trending for years now, and it showed absolutely no sign of slowdown this year.

According to Adobe, mobile, once again, made up more than half of total online traffic at 53% and grew in orders, accounting for 31% of total online sales.

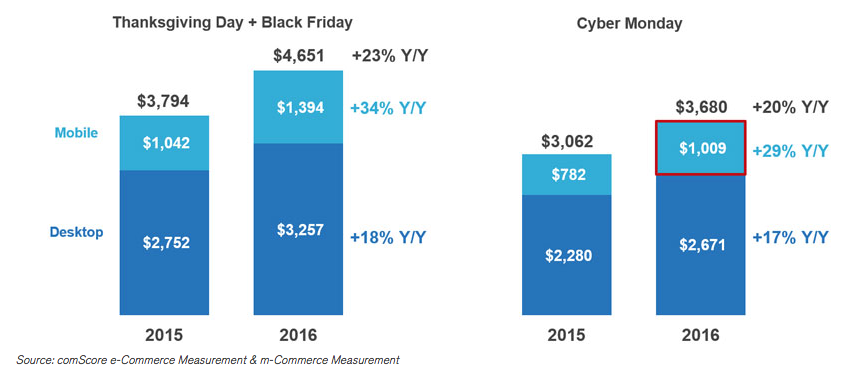

But, according to comScore, mobile went a step beyond pure growth. Cyber Monday witnessed a first for mobile: in a single day, mobile sales totaled more than a billion. As for growth rates, both mobile and desktop are killing it, but mobile jumped twice as high as desktop.

Interestingly, Criteo found that online sales made via tablet are dropping off as smartphone usage and buying behavior spreads — tablets went down by 25% for Android tablets and 12% for iPads, and smartphones went up 58% for iPhones and 27% for Android.

Fulfilling on Fulfillment

On the shipping side of things, e-retailers (more like shipping carriers) were able to deliver on their fulfillment for the most part. Towards the end of December, there’s usually a little commotion about products not getting to the customer’s doorstep on time, and this year wasn’t much different.

Despite much heavier investment in technology, infrastructure, and headcount, most major carriers found themselves slightly lower than 100% on-time. All in all, however, it was a relatively successful shipping season. According to Kurt Salmon, a consulting firm of Accenture, on-time deliveries managed to hit 97% — that’s higher than last year’s 95% and 2014’s 87%. Good signs of consistent improvement.

Up-Time Did Fine

Historically, the holiday gauntlet is legendary for taking down e-retailers’ websites, whether you’re a giant like Best Buy in 2014 or Macy’s in 2016. But there’s a difference between crashing and slowing down a bit. Last year’s holiday season held pretty steady as far as Catchpoint Systems could tell from their research.

While a few sites may have crashed, most stayed up and active, with the largest problem — obviously — being slowdowns due to traffic spikes. Generally, the biggest culprit to slowdowns and crashes had little to do with the actual site and more to do with third-parties connected to it. If an integrated part of a website experiences slowness or goes down, you can expect everything else to follow suit.

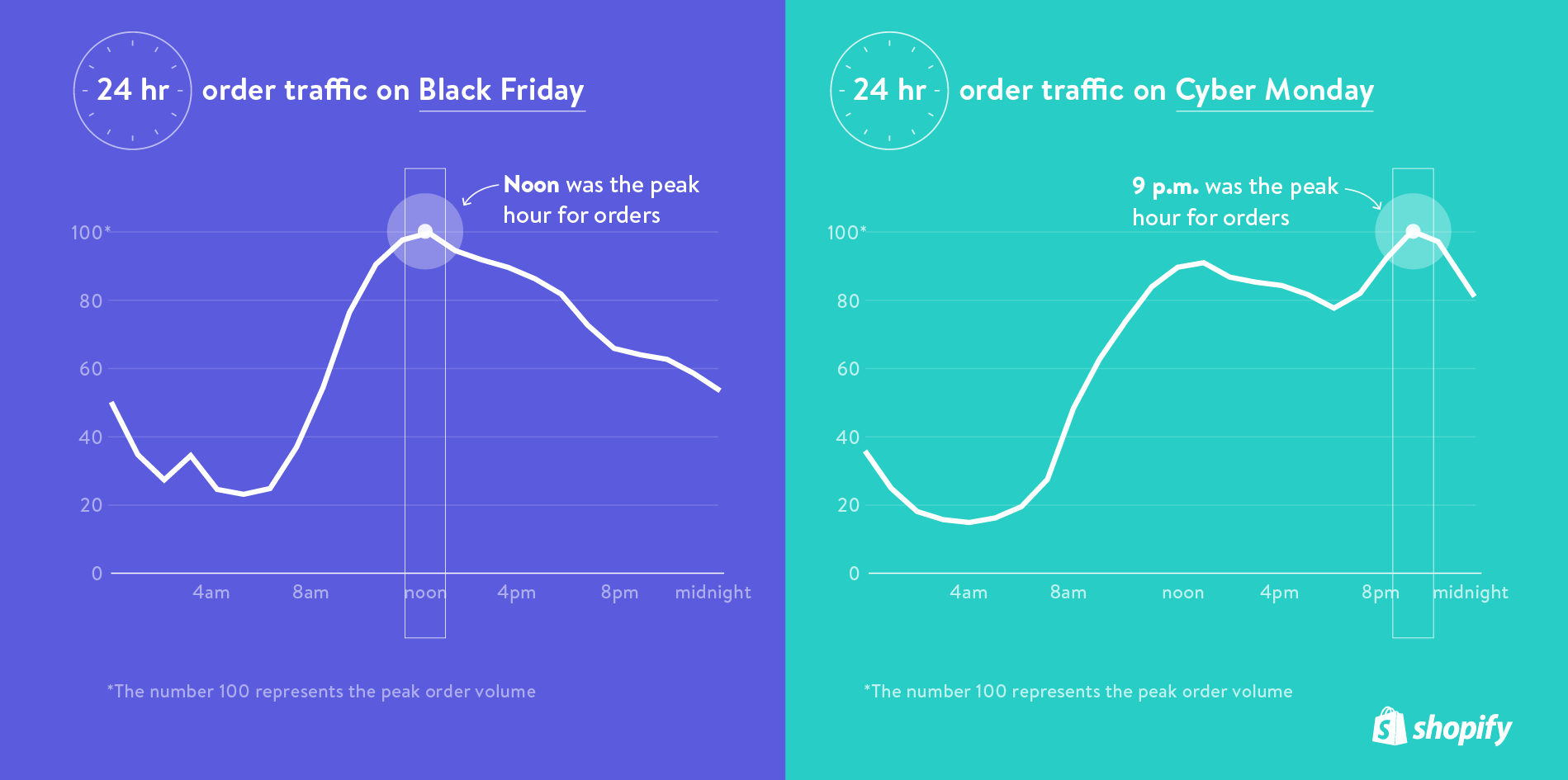

For a glimpse at when those peak traffic times occur, let’s revisit Shopify’s merchant-collected trend data:

Interestingly, peak time for online sales during Black Friday and Cyber Monday seems to revolve around the fact that one’s a holiday and the other a work day. Most consumers have Black Friday off and purchase around noon as their stomachs begin recovering and the day begins ramping up. But Cyber Monday is usually a work day for most consumers, making 9 p.m. — after errands, dinner, and all that stuff — the primetime for orders, rather than during lunch.